Mastering M A Transactions, Peter J. Smith, Esq.<-click here for article

How sellers can fetch top dollar for their companies

Posted by Paul Visokey on Sun, Mar 24, 2019 @06:30 PMTopics: exit, exit planning

The recent stock market corrections caused me to think about what’s coming for private business owners, especially those who are part of the baby boomer generation. Public businesses and private businesses do not fluctuate in value synchronously. Investors in public businesses try to anticipate the future and the value of the business will change quickly. Private businesses are affected more by the current economy, which means there is a lag until the economy impacts the business during an actual recession.

Topics: exit, pre-sale strategies, acquisition, exit planning

This article is the first in a series designed to help staffing company business owners get a better understanding of the current M&A market and terminology. Although the term “multiple” is commonly used in business valuations, this article is intended to provide some additional clarity to the concept.

Topics: EBITDA

This Way to the Egress: What BusinessValuators Need to Tell Their Clients as They Create Their Exit Strategy

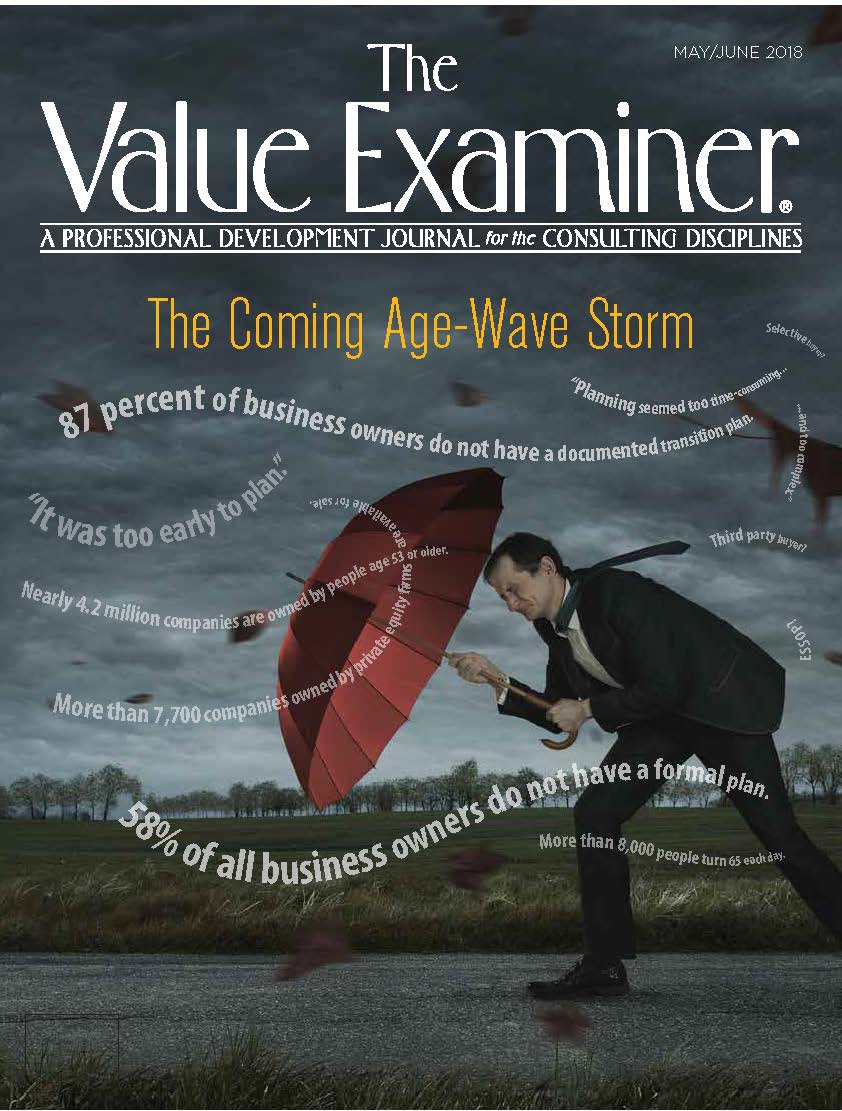

Posted by Paul Visokey on Tue, Oct 02, 2018 @03:44 PMThis article appeared in the May / June 2018 edition of The Value Examiner NACVA article click here

Topics: business valuations